Ethereum’s Staking Surge: One Million Validators and Counting

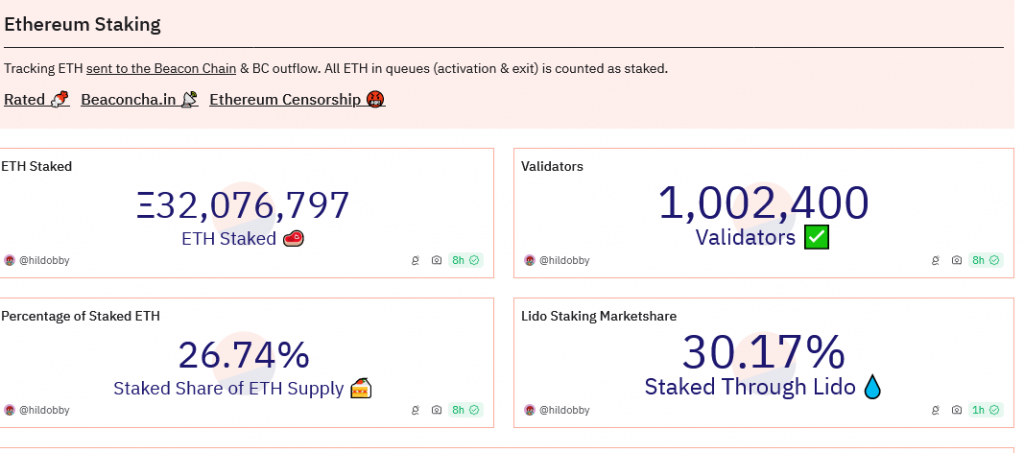

The Ethereum network has achieved a significant milestone by surpassing one million validators, with approximately 32 million Ether (ETH), worth around $114 billion, staked within the network. This staked ETH represents about 26% of the total supply, highlighting the substantial commitment to Ethereum’s proof-of-stake (PoS) consensus mechanism.

TLDR

- The Ethereum network has reached one million validators, with 32 million ETH (approximately $114 billion) staked, representing 26% of the total supply.

- Lido, an Ethereum staking pool, accounts for around 30% of the staked ETH, allowing users with smaller amounts to participate in the staking process.

- Some community members express concerns about potential issues arising from an excessive number of validators, such as increased failed transactions.

- Vitalik Buterin has proposed a mechanism to penalize validators proportionally to their average failure rate, potentially reducing the advantage of larger ETH stakers over smaller ones.

- The SEC has postponed its decision on Ether ETF applications from major financial institutions, with final deadlines extended to May 2024.

Data from the Dune Analytics dashboard, which tracks Ethereum staking progress, revealed that the validator count reached the one million mark on March 28. Validators play a crucial role in maintaining the security of the Ethereum blockchain by monitoring transactions for any malicious activities, such as double-spending.

In Ethereum, validators propose and validate transactions within the network, requiring a stake of 32 ETH. In return for their participation, validators receive rewards in the form of a portion of ETH.

Among the staking options available, Lido, an Ethereum staking pool, accounts for approximately 30% of the staked ETH. Staking pools like Lido allow users with smaller amounts of ETH to pool their assets and participate in the staking process, making it more accessible to a broader range of users.

While a higher number of validators generally enhances blockchain security, some members of the Ethereum community have expressed concerns about potential issues arising from an excessive number of validators.

Evan Van Ness, a venture investor and Ethereum advocate, suggests that there may already be “too much” staked. Gabriel Weide, the operator of a staking pool, warns that an abundance of validators could lead to an increase in “failed transactions.”

Over 1 million Ethereum validators

???? pic.twitter.com/5Rlc6uB8EC

— Evan Van Ness ???? (@evan_van_ness) March 27, 2024

To address the network’s decentralization, Ethereum co-founder Vitalik Buterin recently proposed a mechanism to improve the system. In a blog post, Buterin suggested penalizing validators in proportion to their average failure rate.

By implementing this approach, penalties would be higher if multiple validators fail within a given slot, potentially reducing the advantage of larger ETH stakers over smaller ones.

In related news, the U.S. Securities and Exchange Commission (SEC) has recently postponed its decision on the applications for Ether ETFs from major financial institutions like BlackRock and Fidelity.

The final deadlines for these decisions have been extended to May 2024. The SEC’s decision to extend the deadline follows its earlier postponement in December 2023, during which it sought additional public input on whether the ETF should be listed. Bloomberg Intelligence ETF analysts James Seyffart and Eric Balchunas have both expressed their calibrated predictions of the pending approvals, expecting a potentially persisting denial in May.

As the Ethereum network continues to evolve and grow, the milestone of one million validators demonstrates the increasing interest and participation in the network’s staking mechanism.

The post Ethereum’s Staking Surge: One Million Validators and Counting appeared first on Blockonomi.